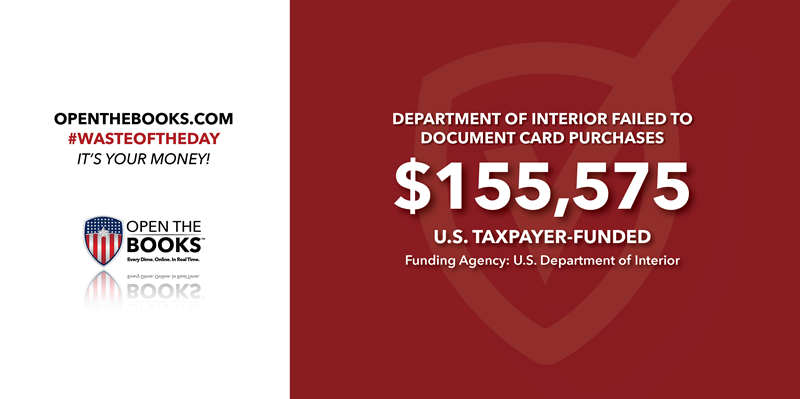

Department of Interior Had No Receipts For $155,575 in Credit Card Purchases

February 28, 2022

While millions of hardworking Americans must take pains to keep track of hundreds of receipts each year for their tax filings, the Department of Interior lost track of documentation for $155,575 worth of purchases last year.

When government employees make expenditures with tax dollars, they are required to keep track of receipts. But according to a DOI Inspector General Report, that didn’t happen for 74 of 149 transactions that the inspector general reviewed. That’s about half of all transactions totaling $155,575. Without the proper documentation, there’s no way to know if this money went to legitimate purchases, or if it was spent on wasteful or self-serving pet projects.

The transactions that were reviewed were 149 high-risk pandemic-related card transactions, some of which were funded through the CARES Act.

One major cause of the lax record keeping is that the DOI keeps increasing the amount that employees can charge to government cards. First, there was a $3,500 limit. Then, it was raised to $10,000. Now, that limit has grown to $20,000.

The biggest culprits within the DOI were the Bureau of Indian Affairs, which had $66,731 in questionable costs, and the National Park Service, which had $41,471, the IG report said.

Providing proof that tax dollars are being used properly shouldn't be too big of an ask.

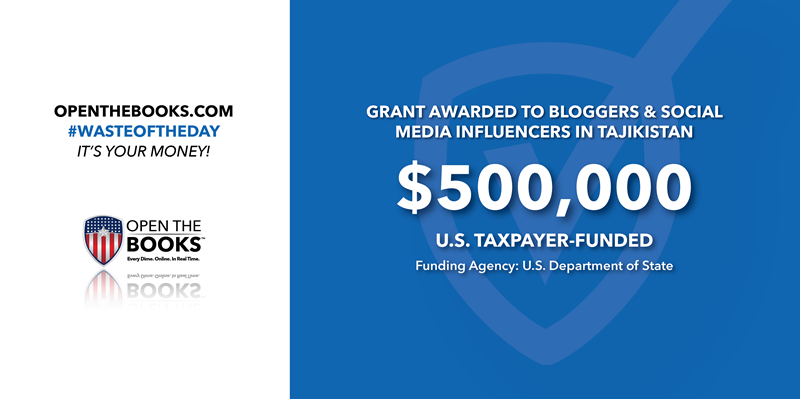

State Department Gives $500,000 to Social Media Bloggers in Tajikistan

March 1, 2022

Who’s your favorite Tajikistani social media influencer? Don’t have one? Well, you soon might. According to a recent grant notice from the U.S. State Department, the U.S. is sending Tajikistan $500,000 to help “Support Independent Media Development and Bloggers.”

The grant notice states, “We will support projects that raise the quality and quantity of visual content created by amateur journalists and bloggers in order to expand their audience with attractive content.”

That’s right, your tax dollars are helping Tajikistani bloggers get more followers and come up with better content.

The grant will also “increase capacity of local journalists and bloggers through training on effective use of social media and providing small grants to those who show the most potential for long-term success; and increase professionalism of social media influencers on topics of public interest and inspire them to post more on such subjects.”

No further details are provided on exactly what topics of public interest qualify.

In addition to improving the social media prowess of bloggers and influencers, the grant can also go toward topics like countering violent extremism, supporting women’s empowerment, and promoting environmental awareness and action.

These all seem more important than the first topic but grant recipients can choose whichever project they like. In theory, every project could go toward supporting social media developers and bloggers instead of countering violent extremism.

It’s hard to say exactly where the problem of small audiences for Tajikistani bloggers and influencers should rank on our list of national priorities, but we think it’s safe to assume it should be near the bottom.

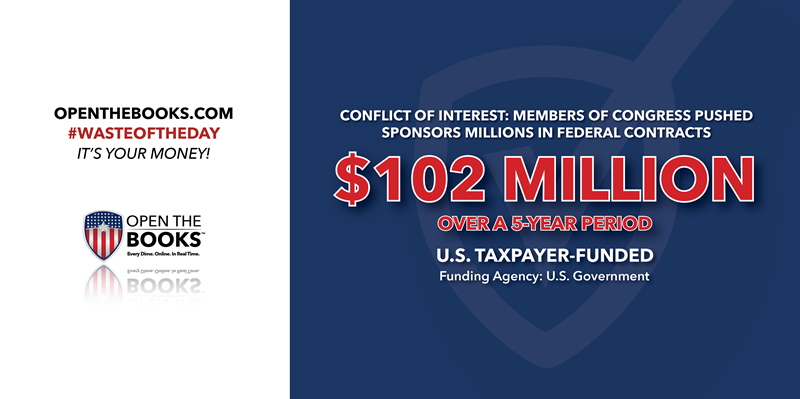

Members of Congress Received 8,000 Free Trips—Including Hundreds Paid for by Non-Profits Who Pocketed $100 Million in Federal Funding

March 2, 2022

Between 2017 and 2021, more than 500 Congress members disclosed that they took more than 8,000 trips paid for by roughly 700 third-party organizations, according to an analysis by OpenTheBooks.com. While this practice is not illegal, it presents lawmakers with a conflict of interest.

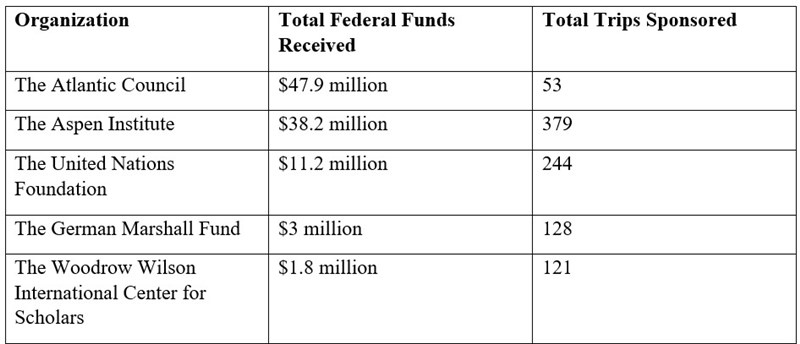

That conflict of interest is most clearly seen through five nonprofit organizations that paid for 925 trips for members of Congress and their staff, who in turn got those organizations $102 million in federal funds over the five-year period we audited.

Members or staffers took about 2,600 trips to foreign destinations vs. about 5,490 trips to domestic destinations. Half the foreign trips went to just five popular overseas destinations: Israel (939); Berlin, Germany (103); Tokyo, Japan (100); Paris, France (102); and Brussels, Belgium (76).

In April 2019, Rep. Vicente Gonzalez and his wife traveled to Amman, Jordan and Beiruit, Lebanon, a trip that cost $20,328.32 and was paid for by the United Nations Foundation. They flew business class, not coach, and reported $14,000 in travel costs alone. Gonzalez, who sits on the House Foreign Affairs Committee, stayed at the Four Seasons while in Amman.

The United Nations receives nearly $10 billion in taxpayer aid to 58 sub-entities each year and its Foundation received $11 million in congressional grants during the last five-year period.

In 1978, Pentagon Wasted $5 Million on Travel and Entertainment

March 3, 2022

Throwback Thursday!

The Department of Defense spent over $1.2 million in 1978 — more than $5 million in 2022 dollars — on travel and entertainment.

Worse, it hid the spending in a fund for “emergencies and extraordinary expenses.”

For this misuse of taxpayer funds, Sen. William Proxmire, a Democrat from Wisconsin, gave a Golden Fleece award to the DOD for Pentagon brass’ spending.

The Pentagon took the funds from its “emergencies and extraordinary expenses” fund to pay for unreimbursed Congressional trips, receptions for foreign military leaders, welcoming parties and going away parties for the Pentagon hierarchy, flowers, corsages, gifts, tea parties for wives, boat cruises, conferences, lunches, dinners, change of command ceremonies and bulk purchases of alcoholic beverages, Proxmire noted in 1978 when he gave the award.

“These funds have been systematically misused,” Proxmire said then. “In one case, a retiring official was given a party by his colleagues with full expenses of $176 charged to the taxpayers. Then several days later, the same official gave a party for his friends at a cost of $271.80, again charging it to the taxpayers.”

Farewell parties for top officials often ran thousands of dollars, he said, while the National Security Agency spent $12,161.74 entertaining foreign visitors and some U.S. citizens.

“Sometimes local military bases entertain local officials with tax dollars,” the senator said. “A preholiday commanders’ reception in Philadelphia for ‘prominent officials and members of the Philadelphia Industrial community’ cost $975. A commanders’ reception for ‘local dignitaries’ in Richmond, Virginia, cost $604.”

Some of the most extensive entertaining was for visiting military leaders from other countries, including Chile, Venezuela, Argentina, Uruguay, Korea, Denmark, Norway, Turkey, Iran. Each trip cost on average about $2,000.

“Obviously, some amount of entertaining for diplomatic purposes may be necessary,” he acknowledged. “But I am convinced that it is an amount far, far less than now being spent.”

Unions Wrongly Received $36.7 Million in PPP Federal Covid Aid

February 25, 2022

One of the most significant Covid-19 relief programs that Congress passed was the Paycheck Protection Program, which was intended to encourage small businesses to keep their staff employed, as well as help with rent, utilities and other expenses.

However, according to a report by the Freedom Foundation, teachers’ unions, government employees’ unions, and AFL-CIO advocacy organizations received 226 loans totaling $36.7 million—even though they were allegedly ineligible.

As the Freedom Foundation explains, “nonprofit eligibility was primarily limited to tax exempt organizations operating under 26 U.S.C. § 501(c)(3), which covers most traditional charitable nonprofits. As labor unions are generally registered with the Internal Revenue Service (IRS) under 26 U.S.C. § 501(c)(5), most were not initially eligible for PPP loans.”

In December 2020, eligibility was expanded to include some labor unions, but the $36.7 million in loans occurred before this expansion.

Using the term “loan” to define this program is an obfuscation. While these technically were loans initially, it was made clear that so long as the recipients didn’t lay off any staff, the loan would be forgiven. Essentially, it was a grant program.

The irony of public sector unions receiving funds is that unions are funded by taking a percentage of its members’ pay, so as long as the members kept their jobs, the unions would not see a change in revenue. Of course, the government didn’t lay anyone off because of the pandemic, so this was free money for them.

The largest recipient was the Michigan Education Association, which received $6.4 million in forgivable PPP loans.

Unions took money that could have been used to keep neighborhood restaurants open and used it to pad their bank accounts.

The #WasteOfTheDay is presented by the forensic auditors at OpenTheBooks.com.