Federal Employees Taking the Day Off Costs $22.6 Billion Annually

March 15, 2021

It sure does pay to be a federal employee. Literally.

Federal employees working for longer than three years, on average, are given 43 paid days off: 10 federal holidays, 13 sick days, and 20 vacation days. Employees who have worked 15 or more years receive 26 vacation days a year.

Our auditors documented these benefits in our report, Mapping the Swamp – A Study of The Administrative State.

If federal employees all took their paid days off, taxpayers would pay out an estimated $22.6 billion annually, or about $524 million per day.

With 43 days off a year (after just three years of service) and a cost to taxpayers of $22.6 billion, “take the day off” can be an expensive gesture in Washington for the 2.1 million federal agency employees, 1.4 million members of the military, and 500,000 postal employees.

2021 Federal Holidays, according to OPM.gov:

- Friday, January 1 – New Year’s Day

- Monday, January 18 – Birthday of Martin Luther King, Jr.

- Wednesday, January 20 – Inauguration Day

- Monday, February 15 – Washington’s Birthday

- Monday, May 31 – Memorial Day

- Monday, July 5 – Independence Day (observed)

- Monday, September 6 – Labor Day

- Monday, October 11 – Columbus Day

- Thursday, November 11 – Veterans Day

- Thursday, November 25 – Thanksgiving Day

- Friday, December 24 – Christmas Day (observed)

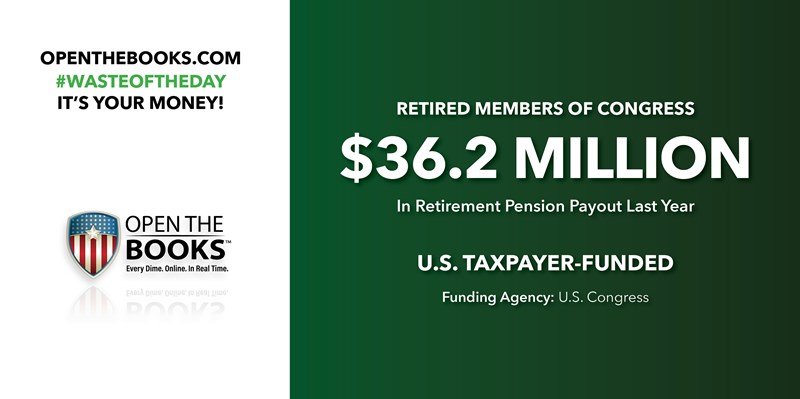

Millionaire Members of Congress and Their Taxpayer-Funded Pensions

March 16, 2021

What do Congressional felons and Congressional millionaires have in common? They both get taxpayer-subsidized pensions.

No members have ever been stripped of their federal pension because of a public corruption conviction – our auditors confirmed this recently.

All members of Congress who serve for five years are pension eligible at 62-years old, or at 50-years old if they serve for 20 years.

Last year, at Forbes, we calculated that House Speaker Nancy Pelosi earned $5.7 million in salary during her 35-year congressional career (from $77,400 to today’s $223,500 as Speaker). We estimated the Speaker, qualifies for a $106,363 annual taxpayer-funded pension, and an additional $47,604 a year in Social Security upon retirement, though she carries an estimated net worth between $43 and $202 million.

Senate Minority Leader Mitch McConnell (with an estimated net worth of $35 million) earned $5.5 million in salary over 37 years (from $75,100 to today’s $193,400, as minority leader in the Senate). Upon retirement, we estimate McConnell (age 79) qualifies for a $96,738 pension, and he’s also eligible for Social security amounting to an additional $46,164 each year.

Former Rep. Duncan Hunter (R-CA) pled to one felony, admitted to converting “more than $150,000 in Campaign funds…for personal use[,]” and was sentenced to 11 months in prison. Congress forgot to include the misuse of campaign funds in its list of 29 pension-disqualifying felonies, so when Hunter turns 55, with or without his Trump presidential pardon, he’s set to collect $24,200, and over $1.2 million in taxpayer-funded pension payouts by the time he’s 81.

Former Rep. Chaka Fattah (D-PA), convicted on 23 counts of racketeering, fraud, and other corruption charges, and sentenced to 10 years in prison, collected his Congressional pension in prison and still does after being released five years early in 2020.

Senators Mike Braun (R-IN), Rick Scott (R-FL) and Rep. Jody Hice (R-GA) have sponsored legislation, efforts we've also highlighted, to open federal pension records to sunshine.

Is America’s $30 Trillion Credit Card Maxed Out?

March 17, 2021

Americans understand personal debt all too well. There are whole industries to help people get out of debt, one even suggests freezing credit cards in ice to delay overspending.

The federal government and D.C. politicians talk about debt. But the last three presidents combined, along with the current president and a lot of help from Congress, have created record-breaking levels of national debt. Yet they are not cutting up their credit cards and they keep voting themselves higher spending limits.

The “national debt” is how much Uncle Sam has borrowed and is supposed to pay back to its creditors, be they private citizens, institutions, foreign governments (publicly held debt), or even itself (intergovernmental debt). National debt is often framed as a percentage of gross domestic product (GDP).

The Congressional Budget Office reported in February that the federal government’s debt is expected to exceed the size of the American economy this year, even before counting the $1.9 trillion COVID-relief package recently signed by President Joe Biden. In fiscal year 2018, debt was 78% of all GDP, and, with all laws extended, it was projected to be 96% of GDP in FY2028. COVID spending moved up our insolvency.

Thanks to the COVID-relief package, President Biden will have added trillions to the national debt in just the first two months of his presidency. The United States has only been debt-free twice, in 1834 and 1835. But our country currently is on an unsustainable spending spree and someone needs to freeze (or cut up) Washington, D.C.’s credit cards, which are more than maxed out.

National debt, according to figures from the Department of Treasury

In eight years, President George W. Bush added $6.1 trillion to the national debt:

- $5.81 trillion debt on September 28, 2001: President George W. Bush’s inherited debt level at the start of his first budgetary year.

- $11.91 trillion debt on September 30, 2009: The end of President Bush’s budgets.

In eight years, President Barack Obama added $8.334 trillion to the national debt:

- $11.91 trillion debt on September 30, 2009: President Obama’s inherited debt level at the start of his first budgetary year.

- $20.244 trillion debt on September 29, 2017: The end of President Obama’s budgets.

Through his four years, up until Inauguration Day, President Donald Trump added $7.51 trillion to the national debt:

- $20.244 trillion debt on September 29, 2017: President Trump’s inherited debt level at the start of his first budgetary year.

- $27.75 trillion debt (of which $21.6 billion was held by the public) on January 20,2021.

Including his last-signed spending bills through September of this year, some estimate Trump will have raised the national debt $7.8 trillion during his term.

Only You Can Prevent $428,000 Smokey Bear Balloon Spending

March 18, 2021

Throwback Thursday!

You might know Smokey the Bear, the long-time mascot of the U.S. Forest Service, who since 1944 has been warning Americans to prevent forest and wildfires. But did you know he has a hot air balloon likeness, which so far has cost taxpayers $428,386? That is a lot of expensive, hot air, even for D.C.

From 2005 through 2020, taxpayers (mostly from the U.S. Forest Service) paid out $428,386 to the Friends of Smokey Bear Balloon for activities related to its hot air balloon. The 97-foot tall, 1,130 pound hot air balloon requires a 12- to 15-person set-up crew and a chase crew to ensure a safe landing, according to the Friends.

The U.S. Army used $5,386 in military funds to fly Smokey over a lake—a non-flammable body of water— for an anniversary party.

In 2017, the Army paid the Friends of Smokey Bear Balloon for the air-born Smokey to join his land-bound friends, like Ronald McDonald, for the a 50th anniversary celebration of Carlyle Lake (which features a dam operated by the Army Corps of Engineers).

Balloon proponents argue the balloon provides visibility and awareness, but the funds spent in the air might be better spent on the ground. There is an average of 60,467 fires caused each year by humans, fires that burn 2.7 million acres annually.

Congress, in recent years, has authorized and appropriated billions in federal funds for wildfires, some caused by humans, others by nature herself. Just last year, a deadly California fire, that burned more than 22,000 acres, was started by pyrotechnics from a gender-reveal party.

No word on whether the expectant family had ever seen the Smokey the Bear hot-air balloon.

USPS Lost $69 Billion Over Last 11 Years

March 19, 2021

Reform, just like the check, is in the mail.

A General Accountability Office (GAO) report found that The United States Postal Service lost $69 billion over the previous 11 fiscal years—including a $3.9 billion loss in fiscal year 2018 and an $8.9 billion loss in 2019 (which was “only” supposed to be a $6.6 billion loss).

In 2020, the USPS posted a $9.2 billion loss, even while its total revenues increased by $2 billion from the previous year to $73 billion. USPS package delivery was up by almost 19% during the pandemic, though it saw 4.2% first-class mail and 15.2% marketing mail declines.

Overall, a $1 increase in USPS revenues resulted in a $1.15 increase in costs during 2020. The more the USPS sold, the more it lost.

Postmaster General Louis DeJoy, who earns $303,460 a year, said, despite a $10 billion Treasury loan under the CARES Act, “the Postal Service… remains on an unsustainable path...” This echoed what he told Congress: there’s “no end in sight” to the agency’s fiscal woes.

OpenTheBooks.com auditors found that last year, the agency hired 163,257 employees, for a net gain of 54,867 employees. In 2020, 50 USPS employees made more than $200,000, and 5,346 employees earned more than $100,000.

Critics have suggested that the service is ossified and in dire need of workplace reforms, while the USPS promises reforms are coming. But there is a reason few are reassured to hear “the check is in the mail.”

The #WasteOfTheDay is presented by the forensic auditors at OpenTheBooks.com.