March 8, 2021

Federal Employees Get $1,400 Per Week – If Kids Not Full-Time in School

Call it a personal bailout for bureaucrats.

The “American Rescue Plan Act of 2021” – a $1.9 trillion emergency aid package to help America recover from the coronavirus pandemic has an extra perk for federal workers: Enhanced paid time off if your child is enrolled in a school that isn’t back to full-time, in-classroom instruction.

The new perk is funded through a new $570 million family leave account exclusively for federal workers.

Full-time federal employees can take up to 600 hours in paid leave until September 30, up to $35 an hour and $1,400 a week. That is 15 weeks for a 40-hour employee. Part-time and “seasonal” employees are eligible, too, with equivalent hours established by their agency.

In 78 large agencies, the average federal worker already made $100,000 in cash compensation and received 43 days of paid-time-off (PTO). Our auditors at OpenTheBooks.com estimate that existing PTO perk costs the American taxpayer $20 billion every year.

While millions of parents struggle to work from home with kids who are enrolled in shuttered or partially-shuttered schools, and while millions more left the workforce or lost jobs to care for their at-home children, evidently parents in the federal bureaucracy need their own, personal Covid-19 bailout.

Here is how a federal employee “caring for a son or daughter” qualifies for the paid leave, specifically:

“if the school or place of care of the son or daughter has been closed, if the school of such son or daughter requires or makes optional a virtual learning instruction model or requires or makes optional a hybrid of in-person and virtual learning instruction models, or the childcare provider of such son or daughter is unavailable, due to Covid-19 precautions...”

The American Rescue Act provided regular Americans – individuals – a one-time $1,400 payment. Federal workers with kids not in school full-time can now receive $1,400 per week – for 15 weeks – up to $21,000!

How is that fair to the hardworking taxpayer?

March 9, 2021

Kanye West – Worth $3.2 Billion – Received $2.4 Million in PPP Funding for His Sneaker Company

A famous singer’s shoe company, a millionaire actor’s film institute, and the California wineries of a legendary filmmaker, probably were not the “little guys” taxpayers thought Congress was targeting in last year’s coronavirus relief Paycheck Protection Program (PPP).

When our auditors at OpenTheBooks.com mapped the big PPP loans (the nearly 83,000 loans between $1 million and $10 million), a few familiar names popped up.

Kanye West, who claims a net worth of $3.2 billion, took $2.4 million for his clothing and sneaker company, Yeezy LLC, which the Wall Street Journal noted had a value of $2.9 billion, with $1.5 billion in yearly revenues.

Robert Redford’s Sundance Institute received $3.04 million in PPP loans. The non-profit’s IRS 990 lists $55.4 million in assets (FY2018).

Two affiliated companies of the legendary Godfather director and vineyard owner Francis Ford Coppola received PPP funding including Francis Ford Coppola Presents LLC ($7.3 million) and Niebaum Coppola Estate Winery, LP ($1.2 million).

A spokesperson told OpenTheBooks.com: “Francis Ford Coppola Winery and Niebaum Coppola Estate Winery, LP applied for the PPP loans based on business necessity and are using the entirety of the loans on wages and benefits to save the employment of its wineries, hospitality, and restaurant workforce during these uncertain times. We are family-owned wine businesses, and the PPP loans have enabled us to bring back over two hundred of our Direct to Consumer employees, even though we may not have work for all them for the foreseeable future.”

The PPP loan program was created to help businesses keep employees on their books, and off unemployment, during the coronavirus pandemic. The loans were forgivable – treated as a grant – as long as the businesses retained their employees and did not cut their paychecks.

So, it is taxpayers who ultimately will pay for most of these loans.

March 10, 2021

$1 Trillion in Non-COVID-Related Coronavirus “Stimulus” & “Relief”

Certainly, the $1.9 trillion American Rescue Plan Act of 2021, provided some targeted COVID aid:

$473 billion in payments to individuals, $75 billion in cash for vaccines, $26 billion to restaurants, $15 billion to help fund airline payrolls, and another $7.2 billion in Paycheck Protection Program funding for small businesses.

The bill also contained about $1 trillion in non-COVID related spending, pork, and policy changes.

For example, the original bill included a hike in the minimum wage to $15 per hour. Even the non-partisan Congressional Budget Office (CBO) determined that move would cost the U.S. economy $1.4 million jobs.

A quick spotlight on agencies and entities receiving “coronavirus recovery” money in the bill includes:

- $350 billion to bailout the states and the District of Columbia. The allocation formula uses the unemployment rate in the fourth quarter of 2020. Therefore, states like New York and California –who had strict economic lockdown policies and high unemployment– will get bailout money. States like Florida and South Dakota – who were open for business – will get less.

- $128.5 billion to fund K-12 education. The CBO determined that most of the money in education will be distributed in 2022 through 2028, when the pandemic is over.

- $86 billion to save nearly 200 pension plans insured by the Pension Benefit Guaranty Corp. There are no reforms mandated while these badly managed pensions are bailed-out. Many of these pension plans are co-managedby unions.

- $50 billion goes to the Federal Emergency Management Agency (FEMA). A portion of these funds is earmarked to reimburse up to $7,000 for funeral and burial costs related to Covid-19 deaths.

- $39.6 billion to higher education. This amount is three times the money – $12.5 billion – that higher ed received from the massive CARES Act last year.

- $1.5 billion for Amtrak – the National Railroad Passenger Corporation. In FY2020, Congress appropriated $3 billion for Amtrak ($2 billion in annual appropriations, plus an additional $1 billion in the CARES Act COVID relief bill). In the three years before the pandemic, AMTRAK lost $392 million – even after a $5 billion taxpayer subsidy (FY2017-FY2019).

Then there is the money for arts, libraries, and museums.

Our auditors found that $470 million in the bill doubles the budgets of The Institute of Museum and Library Services and the National Endowment of the Arts and the Humanities:

- $200 million in the bill to The Institute of Museum and Library Services (FY2019 budget: $230 million). This agency is so small that it does not even employ an inspector general.

- $270 million funds the National Endowment of the Arts and the Humanities (FY2019 budget: $253 million) – In 2017, our study showed eighty-percent of all non-profit grant making flowed to well-heeled organizations with over $1 million in assets.

People are hurting from the global pandemic.

If additional COVID relief was needed for testing, vaccines, small businesses, and individuals, then a narrow, targeted, “skinny” bill would have answered the real need.

March 11, 2021

"Mr. Clean" in San Francisco Was Paid $380,000 Per Year – It Wasn’t Enough

Throwback Thursday!

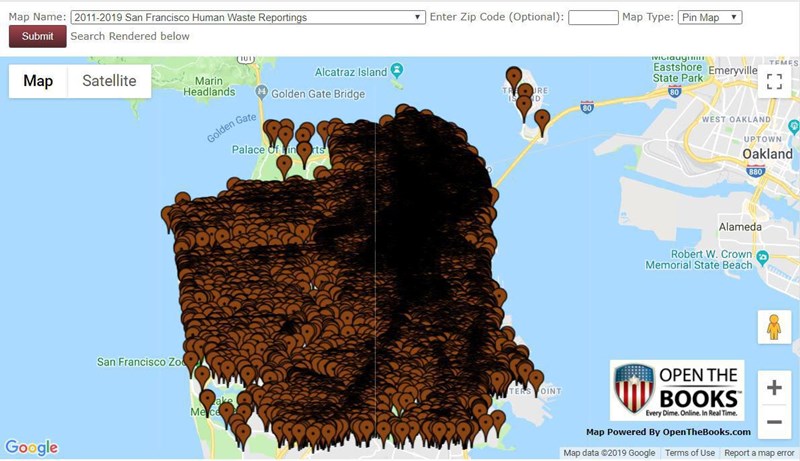

In 2019, we highlighted a tripling in reported human waste in the public way. Citizens filed 10,644 complaints in 2014 and the number of complaints escalated to 30,996 cases by 2019.

Our auditors mapped 118,352 case reports of human waste on city streets – from 2011 to 2019.

Certainly, the poop was deep in San Francisco, but then things really hit the fan.

And the FBI stepped in.

Mohammed Nuru, the public works director and self-titled @MrCleanSF, was in charge of keeping city streets clean and oversaw a $500 million budget. He was indicted by the Department of Justice (DOJ) in 2020.

Nuru was charged with one count of alleged public corruption and is innocent until proven guilty. “The complaint describes a web of corruption involving bribery, kickbacks, and side deals by one of San Francisco’s highest-ranking city employees,” said U.S. Attorney David L. Anderson. “The public is entitled to honest work from public officials, free from manipulation for the official’s own personal benefit and profit.”

Nuru was well paid in his futile attempt to keep San Francisco streets clean. His total taxpayer-funded cash compensation in 2019 was $380,120, and his base salaryhad jumped by $65,000 over eight years. Our auditors at OpenTheBooks.com compiled Nuru’s pay based on Freedom of Information Act requests filed with the City of San Francisco.

Currently, the federal investigation that snared Nuru has charged nine people with one already sentenced.

It seems the streets might not be the only thing dirty in the Bay Area.

March 12, 2021

Gov. Cuomo Solicited Millions in Campaign Cash From State Vendors

Soliciting state contractors for campaign cash opens up Gov. Andrew Cuomo to ethical questions.

Our auditors at OpenTheBooks.com found 347 state vendors that gave $6.2 million in political donations to Cuomo over a six-year period (2014-2019). Meanwhile, these companies reaped $7 billion in state payments.

We reached out to Governor Cuomo and Rich Azzopardi, a senior advisor, answered for the administration, “No contribution of any size plays a role in any official action and any official who can be swayed by a single dollar has no business being in government.”

In New York, however, this political patronage is perfectly legal (at least for now).

Cuomo solicited campaign cash from big accounting firms, law firms, banks, cable companies, developers, telco’s, and even LLCs.

Here’s just one example:

The big four accounting firms, Deloitte; Ernst & Young (EY); KPMG; and PriceWaterhouseCooper (PwC) collectively gave Gov. Cuomo $360,000 in campaign donations from 2014-2019. The firms reaped $258.8 million in state payments.

Are these firms “independent” auditors with a fiduciary responsibility to taxpayers? We found that the firms coordinated their campaign cash to the governor giving the same amounts on the same days in the same years.

In fact, three of the Big Four – PwC, KPMG, and EY – each gave the exact same amount of campaign cash to Cuomo during the six-year period ($88,333.33). Deloitte contributed another $105,000.

Even in Illinois, where the number-one manufactured product is corruption, a 2011 law barred state vendors with contracts exceeding $50,000 from giving campaign donations to statewide officeholders.

In all the examples identified above, no quid-pro-quo is alleged or implied; however, the patterns are troubling. In fact, the individual transactions are probably legal at arm’s length.

The #WasteOfTheDay is presented by the forensic auditors at OpenTheBooks.com.