TOP 10 TAKEAWAYS

1. TOTAL MISTAKES

$175 billion in estimated improper payments reported by the 20 largest federal agencies, averaging $14.6 billion per month. Total (FY2004-FY2019): $2.3 trillion.

2. WORST PROGRAMS

Billion-dollar Boondoggles: $121 billion (approximately 69 percent) in improper payments occurred within three program areas – Medicaid, Medicare, and Earned Income Tax Credit.

3. CLAW BACK

Recapture totaled $21.1 billion of the $175 billion improper payments during 2019 — roughly 14 cents on every dollar misspent. Five-year total: $103.6 billion recaptured/ $747.7 billion improperly spent.

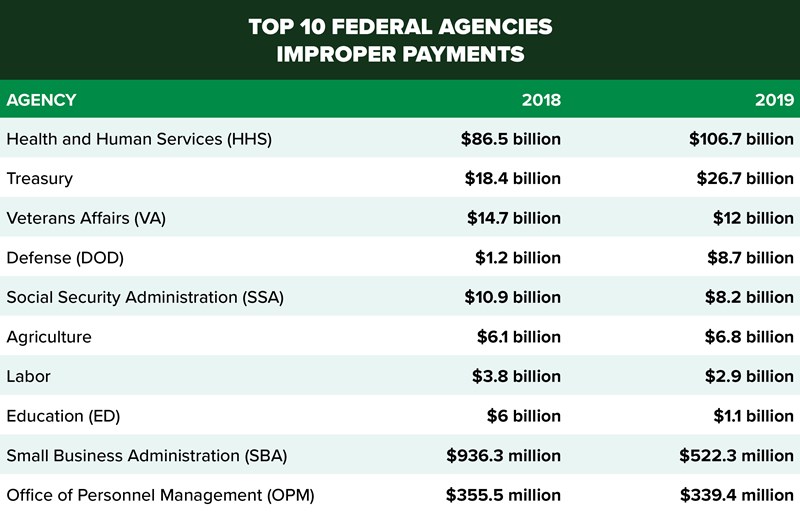

4. TOP 10 WORST AGENCIES

5. BAD BOOKKEEPING

Dead people received $871.9 million in mistaken payments. Medicaid, social security payments, federal retirement annuity payouts (pensions), and even farm subsidies were sent to dead recipients.

Root cause: failure to verify death

Four-year total: $2.8 billion

6. ANCIENT AMERICANS

Six million Social Security numbers are active for people aged 112 ; however, only 40 people in the world are known to be older than 112 years of age.

7. WORST TREND

Medicaid and Medicare improper payments soared from $64 billion (2012) to $88.6 billion (2017), and, in 2019, to $103.6 billion. Five-year total: $456 billion

8. BEST TURNAROUND

In 2018, the Education Department overpaid $6 billion to college students receiving PELL grants and student loans. In 2019, improper payments were reduced to $1.1 billion – an 85-percent reduction.

9. IMPROPER INCOME REDISTRIBUTION

$17.4 billion in improper payments by the Internal Revenue Service (IRS) within the Earned Income Tax Credit program. 25-percent of all payments were improper. Five-year total: $84.35 billion

10. PURCHASING POWER

What can $175 billion buy?