By Adam Andrzejewski

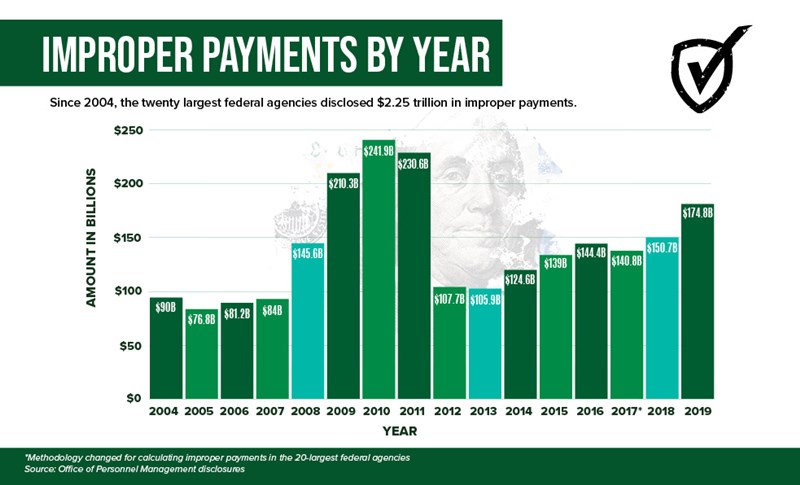

Since 2004, twenty large federal agencies have admitted to disbursing an astonishing $2.25 trillion in improper payments.

Last year, these improper payments totaled $175 billion – that’s about $15 billion per month, $500 million per day, and $1 million a minute.

But what exactly is an improper payment?

Federal law defines the term as “payments made by the government to the wrong person, in the wrong amount, or for the wrong reason.”

When people or companies receive incorrect payments, it erodes trust and hinders the government’s ability to finance everything from defense to health care.

Recently, our auditors at OpenTheBooks.com published a 24-page oversight report analyzing why, how, and where federal agencies wasted our tax dollars last year.

Here are the top 10 takeaways regarding improper and mistaken payments by the 20 largest federal agencies in 2019:

1. Total Mistakes: $175 billion in estimated improper payments reported by the 20 largest federal agencies, averaging $14.6 billion per month – Total (FY2004-FY2019): $2.25 trillion

2. Worst Programs: $121 billion (approximately 69 percent) in improper payments occurred within three program areas – Medicaid, Medicare, and Earned Income Tax Credit.

3. Claw Back: only $21.1 billion of the $175 billion improper payments during 2019 was recaptured — that’s only 14 cents on every dollar misspent. Five-year total: $103.6 billion recaptured/ $747.7 billion improperly spent

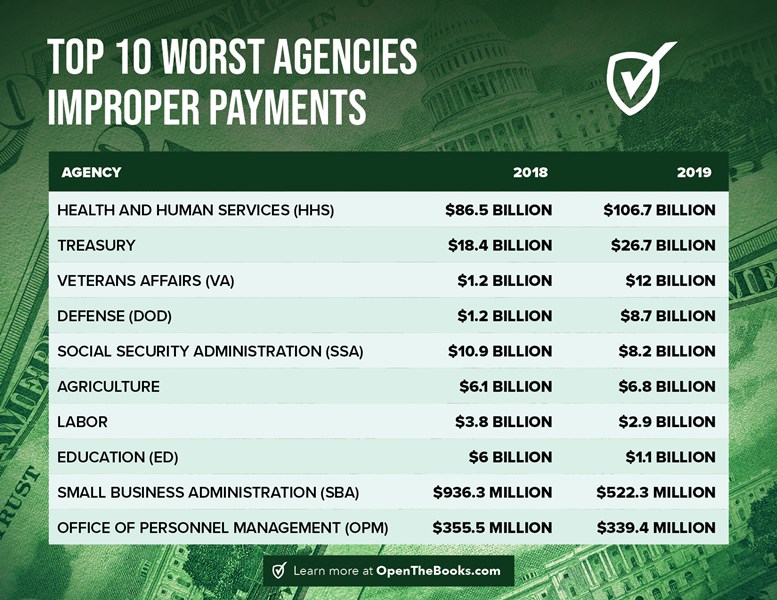

4. Biggest Offenders:

5. Dead people: $871.9 million in mistaken payments were made to dead people. Medicaid, social security payments, federal retirement annuity payouts (pensions), and even farm subsidies were sent to dead recipients. Root cause: failure to verify death. Four-year total: $2.8 billion

6. Ancient Americans: Six million Social Security numbers are active for people aged 112 ; however, only 40 people in the world are known to be older than 112 years of age.

7. Worst Upward Trend: Medicaid and Medicare improper payments soared from $64 billion (2012) to $88.6 billion (2017), and, in 2019, to $103.6 billion. Five-year total: $456 billion

8. Best Turnaround: In 2018, the Education Department overpaid $6 billion to college students receiving PELL grants and student loans. In 2019, improper payments were reduced to $1.1 billion – an 85-percent reduction.

9. Improper Income Redistribution: $17.4 billion in improper payments by the Internal Revenue Service (IRS) within the Earned Income Tax Credit program. 25-percent of all payments were improper. Five-year total: $84.35 billion

10. Purchasing Power: What can $175 billion buy? Last year, the federal government wasted the equivalent of a full year of all federal salaries, perks, and pension benefits for every employee of the federal executive agencies. A stunning example of institutionalized incompetence.

.jpg)

Justifications for their improper payments vary by agency.

For example, Veterans Affairs (VA) says they are working on the problem and, yet, have a long way to go:

“During FY19 testing for improper payments, VA found that many root causes of improper payments still have not been remediated. While the VA is actively working corrective actions to remediate these complex problems, VA completes its statically valid testing for Improper Payments Elimination & Recovery Act) one year in arrears…”

The Internal Revenue Service (IRS) flat out admits that their improper payments ($17.4 billion FY2019) will continue:

“… the IRS does not have the resources to audit every return claiming return tax credits… Without legislative change to greatly improve effective tools to administer these credits, the improper payment rate will not drastically change.”

Over the years, improper payments is an issue that has attracted reform efforts on both sides of the aisle.

In 2009, President Barack Obama issued an executive order to stop improper payments in the core programs of the federal government. Core programs provide services such as Medicare and Medicaid.

In 2020, President Donald Trump emphasized the importance of eliminating improper payments in the President’s Budget to Congress FY2021.

But with billions of dollars misspent every year, it’s obvious that both administrations failed to successfully address the issue of improper payments and much more needs to be done.